Capital Preservation while understood as wealth preservation where one has a will or trust wherein investment portfolios and insurance are held may not necessarily preserve capital.

UBB Amanah have taken a different approach and have concluded that your trust capital should have the same capability and purchasing power several years down the road from your initial trust date. With inflation rising with no specific limit, it is our intent to assist our clients to combat inflation and halt erosion of your capital for the foreseeable future at least. Besides having all the salient benefits of a trust, we believe that if one intends to leave a sum of money and assets for their next of kin, it would be good to leave the intended capital that is capable of achieving the value and the needs of that time.

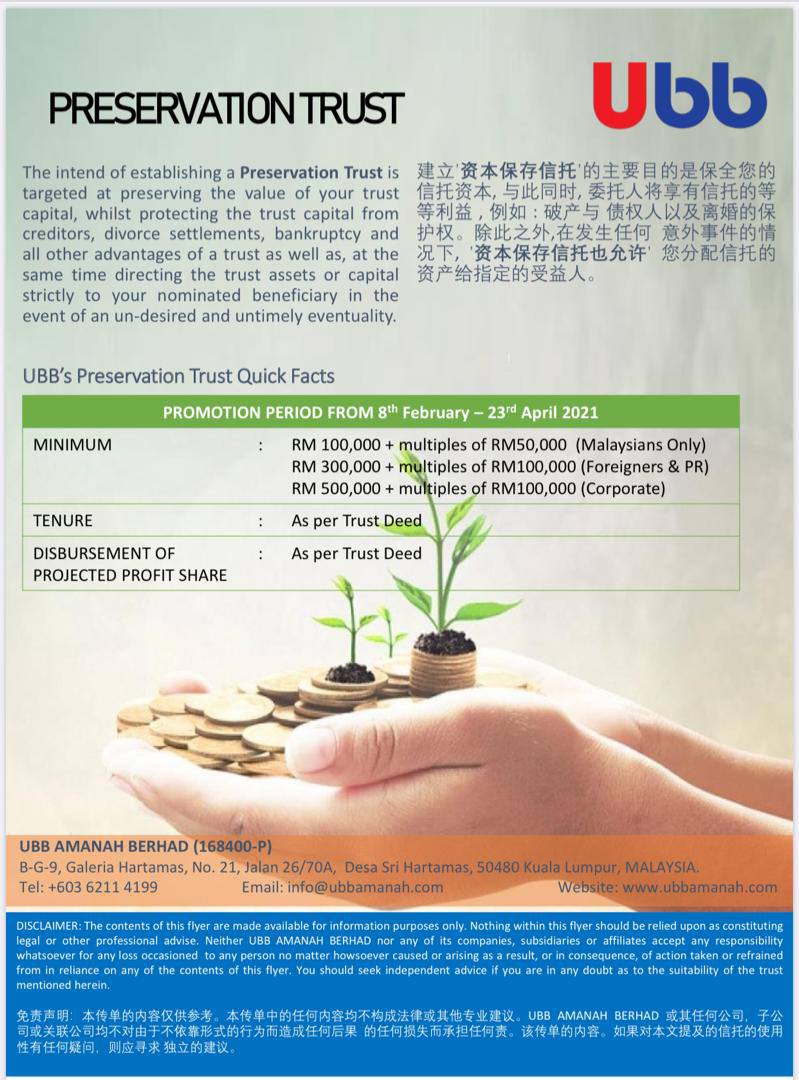

The bottom line is that trusts aren’t only useful to protect the assets from beneficiaries who may not know how to manage their money. A properly-drafted Preservation Trust offers both protection and flexibility, it also preserves your hard earned assets for your loved ones to benefit from.

Contact us or our advisors nationwide for more info!

situs slot gacor toto slot toto slot slot gacor